Launched in 1999, Tradex Global Equity Fund targets long-term growth by investing in stocks worldwide, spanning North America, Europe, and Asia. Managed by City of London Investment Management Company Limited, the fund employs an approach that assesses global stock markets, industry sectors, and currencies for optimal return potential. Key economic and financial indicators, such as industrial production, interest rates, consumer price indices, and GDP, inform investment decisions.

Investment Objective:

Our goal is long-term capital appreciation through investments primarily in closed-end funds. These funds focus on diversified portfolios of equity securities from companies worldwide.

Suitable for investors who:

- Seek to invest in a broad range of foreign stocks

- Are willing to handle the ups and downs of the stock market and accept foreign currency risk associated with investing in foreign stocks

- Are willing to accept a medium level of risk and are looking for a medium to long term investment

- Seek access to a diversified global equity investment with a long term successful unique trading strategy

On Environmental, Social and Governance Issues

Read the ESG in Closed-End Fund Strategies from CLIM, for more details on Environmental, Social, and Governance issues.

Read the Annual Stewardship Report 2022 document from CLIM.

Fund Details

Inception date:

May 7, 1999

Portfolio Manager:

City of London Investment Management Company Limited

Total value on June 30, 2025:

$63.2 Million

Eligible for registered plans:

Yes

Minimum initial investment*:

$1,000

Minimum subsequent investment:

$100

Fund code:

TMI003

Risk Rating:

Medium

*The $1,000 minimum is waived in cases where the investor sets up a regular pre-authorized debit plan from his/her bank account. It is also waived in cases where parents or grandparents establish an in trust account for a minor.

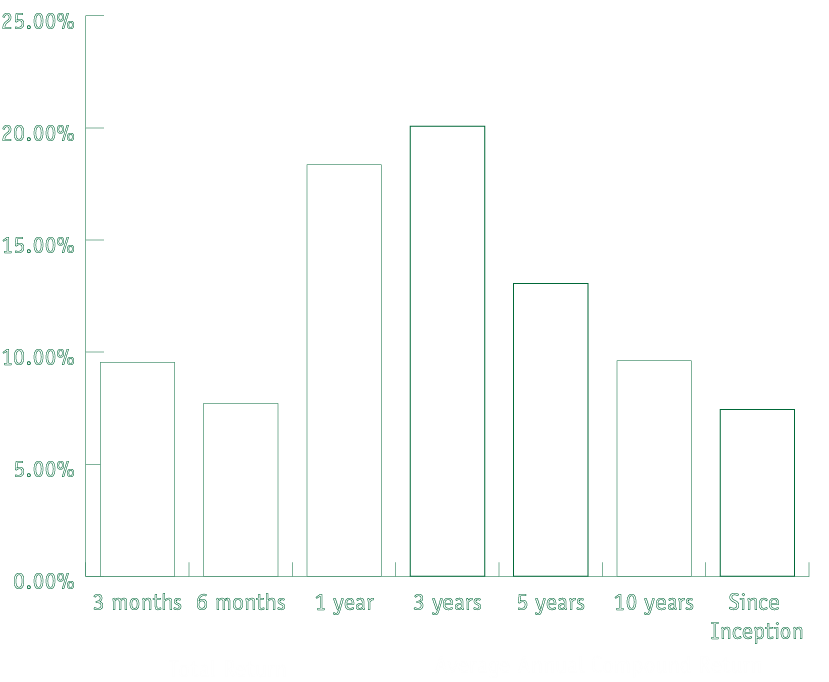

Compound Returns

Closed-End vs Open-End Funds

Closed-End Fund (Investment Trust) | Open-End Fund (Mutual Fund or Unit Trust) | |

|---|---|---|

A participation is defined as | A share | A unit |

The net asset value (NAV) of each participation is defined as | The total value of the portfolio divided by the number of share | The total value of the portfolio divided by the number of units |

Capital Structure, i.e., the number of shares or units in issue, is | Fixed (thus “closed” end) | Variable (thus “open” end) |

Shares or units trade at | Whatever value the stock market puts on them. This might be a premium or a discount to net asset value depending on demand because supply is fixed.

Closed-end funds are listed and traded on a stock exchange via a stock broker | Net asset value with supply and demand being reflected in the number of units in issue.

Open-end funds are bought and sold through that fund’s manager |

In effect, a closed-end fund trades at a price that reflects demand. Demand or the lack of it is reflected in shares trading at a premium or a discount to net asset value. Since the capital structure is fixed, as with any other stock, the stock market determines the share price based upon supply and demand.

In an open-end fund, all units trade at net asset value as the number of units are variable. The manager varies the number of units in issue to take account of supply and demand and enlarges or reduces the size of the portfolio accordingly.

Source: City of London Investment Management

Quarterly Reports on the Fund

Legal & Regulatory Documents

Environmental, Social, and Governance Issues

Explore Tradex’s Diverse Mutual Fund Offerings

Tradex Global Equity Fund

Our unique global equity offering exploiting opportunities in closed-end funds

Book a Free Consultation Today

Book a consultation today and discover insights and strategies tailored to your financial journey with Tradex.