Allocation vs Location

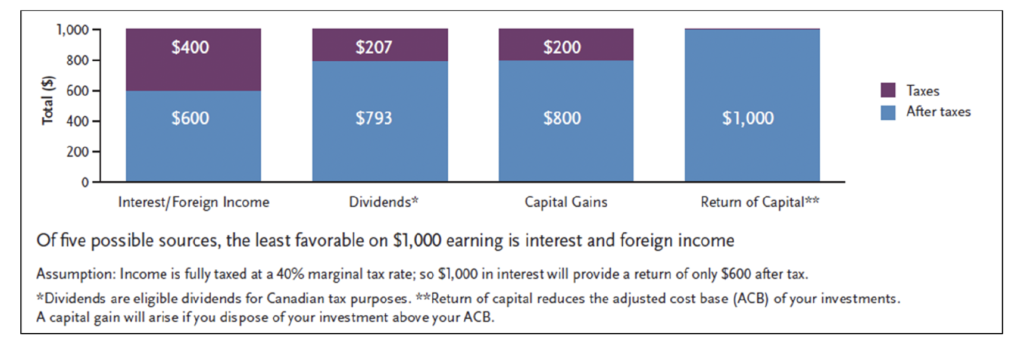

The graphic below illustrates the tax impact of different types of distributions on $1,000 of earnings.

• Interest and foreign income are taxed at a 40% marginal tax rate, resulting in the investor keeping $600 of the $1000. With corporate class funds, this would never happen as they are structured as Canadian corporations.

• Eligible Canadian dividends are taxed at a favourable rate through the dividend tax credit. In this case, the total tax would be $207

• Capital gains have a 50% inclusion rate, meaning only $200 would go to taxes.

• None of the amounts is taxed for the return of capital in the year the distribution was received. Instead, the adjusted cost base (ACB) is reduced by the distribution amount, leading to a higher capital gain in the future. In effect, the ROC distribution is deferred capital gain distribution.

- Once the ACB has been reduced to zero, ROC payments are taxed as capital gains (i.e. 50% inclusion rate under $250,000 per year).