Established in 1989, Tradex Bond Fund aims for consistent income and long-term capital preservation. Managed by Foyston, Gordon & Payne Inc since 2013, the portfolio advisor employs a conservative approach, focusing on interest rate anticipation, credit sector selection, and security selection. The strategy, based on long-term, value-oriented principles, integrates macroeconomic and technical analysis to select bonds with optimal risk/return profiles.

Investment Objective:

Our objective is to combine income generation with long-term capital preservation by investing primarily in a diversified portfolio of Canadian investment-grade bonds. Additionally, we allocate up to 30% of the portfolio to income-producing equity securities, such as dividend-paying Canadian stocks, real estate investment trusts, preferred shares, and income trusts. We aim for the bond portfolio’s average term to maturity to exceed three years.

Suitable for investors who:

- Seek a regular income from their investment

- Seek a diversified income fund that will provide moderate capital growth

- Are willing to accept a low level of risk and are looking for a medium to long term investment

- Seek a low-cost, actively managed, enhanced Canadian fixed-income opportunity

For more details on Environmental, Social, and Governance (ESG) Factors, as utilized by Foyston, Gordon and Payne Inc.

Fund Details

Inception date:

September 7, 1989

Portfolio Manager:

Foyston, Gordon and Payne Inc.

Total value on June 30, 2025:

$26.38 Million

Eligible for registered plans:

Yes

Minimum initial investment*:

$1,000

Minimum subsequent investment:

$100

Fund code:

TMI002

Risk Rating:

Low

*The $1,000 minimum is waived in cases where the investor sets up a regular pre-authorized debit plan from his/her bank account. It is also waived in cases where parents or grandparents establish an in trust account for a minor.

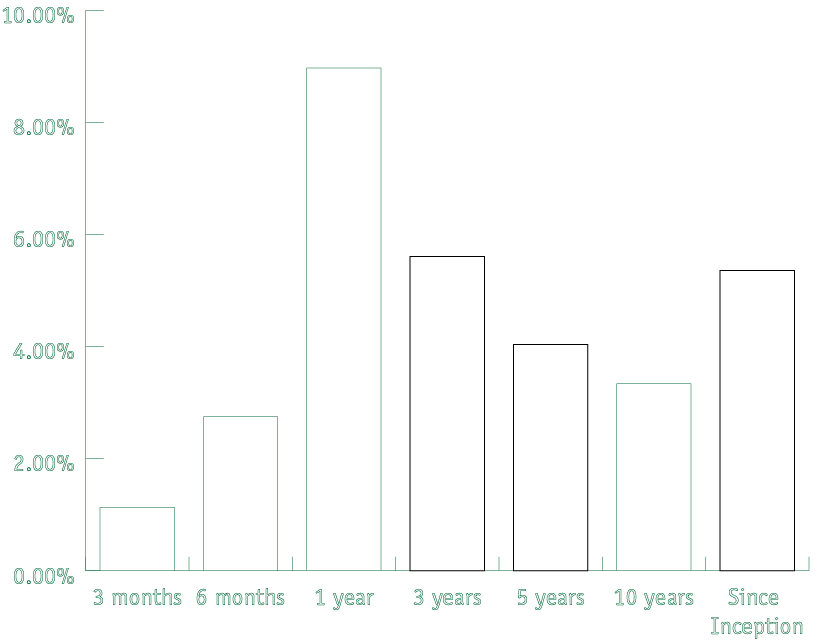

Compound Returns

Quarterly Reports on the Fund

Legal & Regulatory Documents

Environmental, Social, and Governance Issues

Explore Tradex’s Diverse Mutual Fund Offerings

Tradex Bond Fund

Our enhanced Canadian fixed-income offering

Tradex Global Equity Fund

Our unique global equity offering exploiting opportunities in closed-end funds

Book a Free Consultation Today

Book a consultation today and discover insights and strategies tailored to your financial journey with Tradex.