Established in April 1960, Tradex Equity Fund Limited is among Canadas oldest mutual funds. Managed by Philips, Hager & North (PH&N), a division of RBC Global Asset Management Inc., it aims for long-term growth through investments in high-quality, growing companies. The fund may concentrate on stocks and sectors and hold a significant portion of small-cap stocks when advantageous, typically maintaining full investment.

Investment Objective:

To achieve long-term capital appreciation by investing primarily in a diversified portfolio of common shares of Canadian companies plus shares from companies in the United States and other countries.

Suitable for investors who:

- Seek to invest in a broad range of Canadian and global companies

- Are able to handle the ups and downs of the stock market

- Are looking for a medium to long-term investment

- Wish to access a low-cost actively managed Canadian-focused equity fund with a long tradition of success

Approach to Responsible Investment

Approach to RI Brochure 2024 – PH&N

Fund Details

Inception date:

April 11, 1960

Portfolio Manager:

Phillips, Hager & North Investment Management

Total value on June 30, 2025:

$170.62 Million

Eligible for registered plans:

Yes

Minimum initial investment*:

$1,000

Minimum subsequent investment:

$100

Fund code:

TMI001

Risk Rating:

Medium

*The $1,000 minimum is waived in cases where the investor sets up a regular pre-authorized debit plan from his/her bank account. It is also waived in cases where parents or grandparents establish an in trust account for a minor.

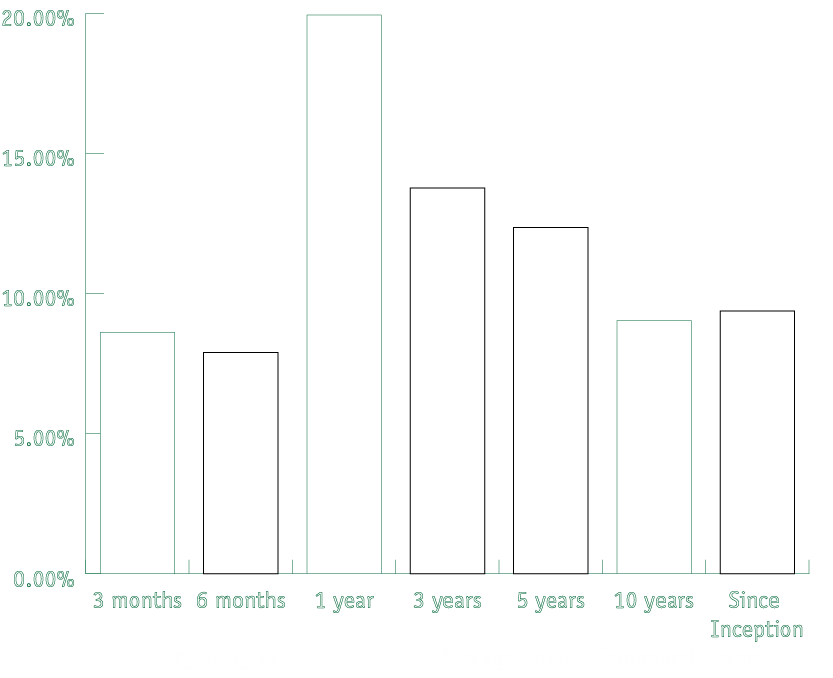

Compound Returns

Tradex Quarterly Newsletter with Fund Updates

Legal & Regulatory Documents

Environmental, Social, and Governance Issues

Explore Tradex’s Diverse Mutual Fund Offerings

Tradex Equity Fund Limited

Our flagship offering with Canadian and Global equities

Tradex Global Equity Fund

Our unique global equity offering exploiting opportunities in closed-end funds

Book a Free Consultation Today

Book a consultation today and discover insights and strategies tailored to your financial journey with Tradex.