Corporate Class Funds

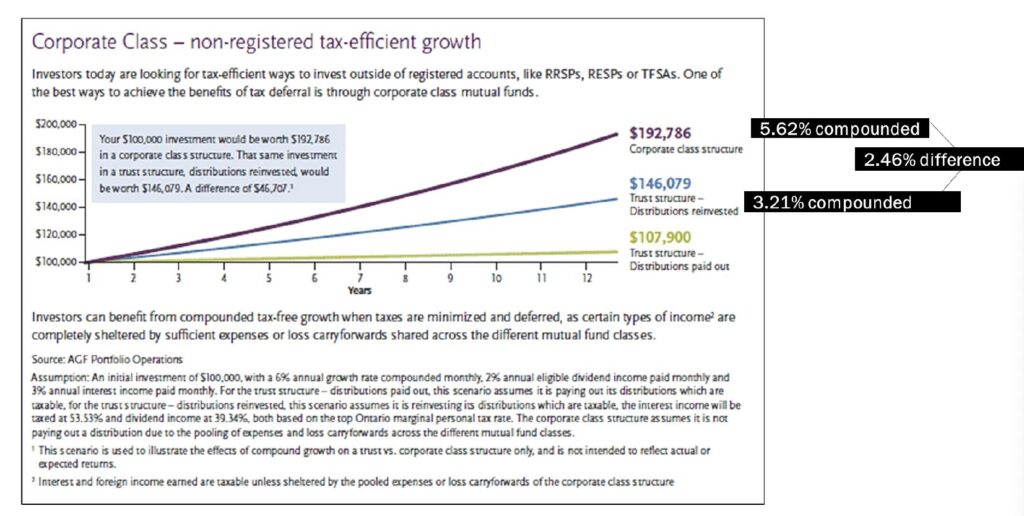

This graph illustrates how incorporating corporate class funds in a non-registered account is more beneficial to the investor than the typical trust funds.

• An initial investment of $100,000 grows at 6% per year over 12 years, contrasting the final return if invested in a mutual fund trust versus a mutual fund corporate class structure.

• The mutual fund trust structure with reinvested distributions is growing at 3.21% per year on average, while the more tax-efficient corporate class structure is growing at 5.6% per year on average, so that’s nearly 2.5% per year of additional growth due to the tax impact.

• This 2.5% difference is due to the corporate class structure not paying out a distribution due to the pooling of expenses and loss carry forwards across the different mutual fund classes.

Key Features of Corporate Class Funds | How Can This Generate Tax Advantages? |

|---|---|

Ability to aggregate income and expenses across mandates within the Corporate class structure | Generally eliminates interest income and foreign dividends, the most highly taxed forms of income |

Low Dividend Policy | May minimize eligible dividends |

Distributions in the form of Canadian eligible dividends, capital gains and return of capital, regardless of mandate | Canadian eligible dividends and capital gains distributions are more tax efficient compared to interest and foreign income |

Ability to generate tax-efficient cash flow through T-Class funds | T-Class can oprovide more after-tax cash flow in the form of tax-deferred return of capital. (Taxes are deferred until the adjusted cost base (ACB) is depleted or shares are redeemed) |