RRSP vs TFSA

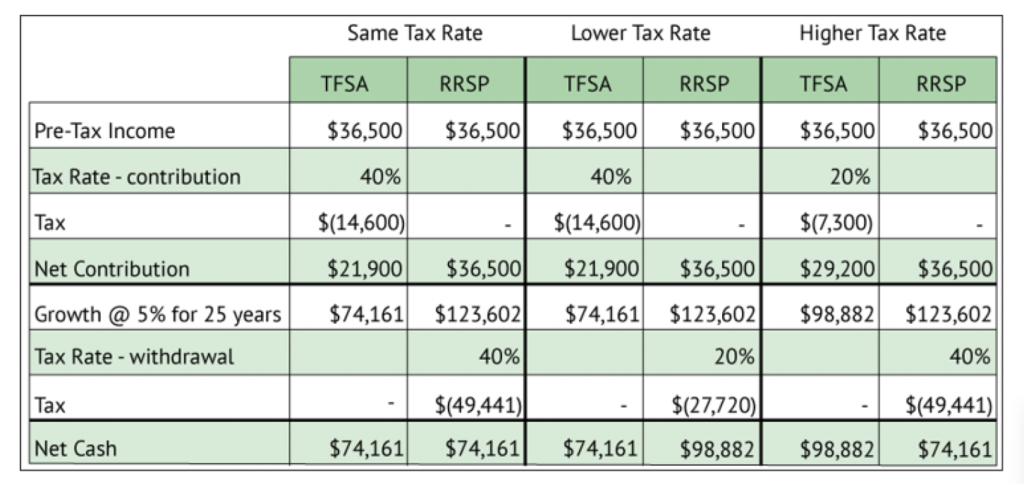

This example compares the financial outcomes of using a Tax-Free Savings Account (TFSA) versus a Registered Retirement Savings Plan (RRSP) under different tax scenarios. The table is divided into three columns, representing different tax rates at the time of withdrawal: the same, lower, and higher tax rates compared to the tax rate at the time of contribution.

Starting with the same tax rate scenario, both the TFSA and RRSP assume a pre-tax income of $36,500. If you contribute to a TFSA, you pay tax on your income upfront, which, at a 40% tax rate, reduces your net contribution to $21,900. This amount is then invested, growing at an assumed rate of 5% annually over 25 years, resulting in $74,161. Since withdrawals from a TFSA are tax-free, the entire amount of $74,161 is yours to keep. In contrast, with an RRSP, you don’t pay taxes on your contribution, so you can invest the full $36,500, which grows to $123,602 over the same period. However, when you

withdraw from an RRSP, you are taxed at the same 40% rate, leaving you with $74,161—identical to the TFSA outcome.

In the lower tax rate scenario, where the tax rate at withdrawal is 20%, the TFSA scenario remains unchanged because TFSA withdrawals are not taxed. The RRSP, however, benefits from the lower tax rate at withdrawal. The $123,602 in the RRSP is taxed at 20%, leaving you with $98,882—significantly more than the TFSA’s $74,161.

In the higher tax rate scenario, where the tax rate increases to 50% by withdrawal, the TFSA remains advantageous. Your investment in the TFSA is still $98,882 since withdrawals are tax-free. However, the RRSP balance of $123,602 is now taxed at 50%, reducing your net withdrawal to $61,801, less than what you’d have with the TFSA.

This comparison underscores how your expected tax rate at the withdrawal time can significantly influence whether a TFSA or RRSP is the better choice for your retirement savings. If you expect your retirement tax rate to lower, an RRSP may offer greater benefits. However, if you expect higher or even the same tax rates, a TFSA could be more advantageous.